Vilnius, Lithuania, 18 June 2021, ZEXPRWIRE, Moonpeer offers a new and innovative way to diversify investments on peer to peer lending and crowdfunding platforms.

So if you are considering investing through the platform, we recommend that you read this Moonpeer’s review first. Because here we take a look at whether or not it’s worth using them. We promise you will get a better feel for the platform through our review.

What is Moonpeer?

Moonpeer is a peer to peer lending and crowdfunding investment platform. They aggregate and source deals from some of the major European peer to peer lendig and crowdfunding platforms. By using Moonpeer, you will basically have access to deals from over 10 platforms with just one account.

Some of the project originators you can find on Moonpeer includes Moncera, Kviku Finance, Neo Finance and etc.

Due to the fact that Moonpeer is a layer on top of the other platforms, they are also able to offer features like a automated investment without directly going to multiple P2P platforms.

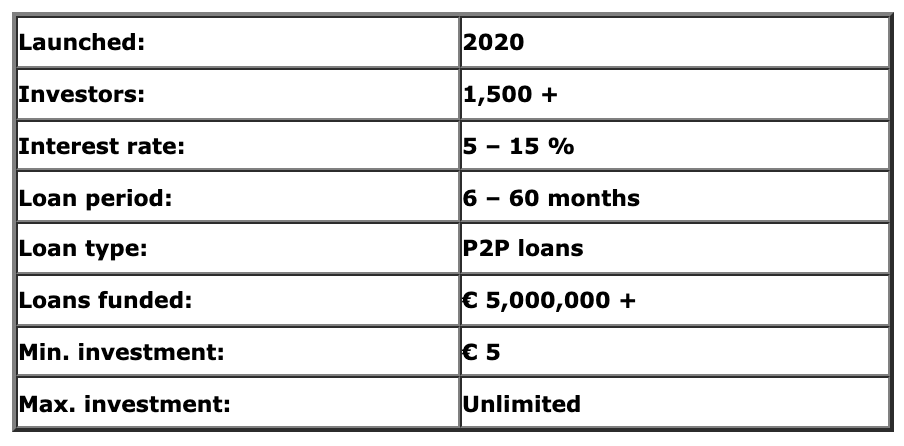

Moonpeer statistics:

Moonpeer offers P2P investment platforms analysis, research, scoring & monitoring services to investors

Research

Which lending platforms are achieving their targeted returns and which aren’t? Where are the best investment opportunities in the European direct lending market? Moonpeer helps investors navigate through the complexity, helping to reduce risk and increase returns over the long term.

Analysis

The early stage of the peer to peer lending market makes it difficult to assess credit risk. Lenders typically operate in niche sub-sectors with separate risk profiles. Moonpeer carries out risk management services to help ensure risks are identified, measured and mitigated. This ensures expected returns are realised.

Monitoring

Monitoring investments is challenging as the data delivered by the lenders is not standardised. Moonpeer pulls all of this data together so performance data is consistent

What rate of return can you expect?

The return you will get on Moonpeer depends on many factors including which project originators you choose as well as what types of projects you invest in:

Rent

If you invest your money in rent, you are practically owning small bits of property. This is the lowest risk investment on the platform, and according to Moonpeer, you can expect somewhere around 2-6% in annual returns as well as capital appreciation.

Fixed-interest loans

If you invest in fixed-interest loans, you are practically providing financing for real estate development companies. These loans are typically secured by real estate as collateral and have a projected interest of around 8-13%.

Equity

If you want a high risk and possibly also a high reward, you can invest in equity. Here, you can potentially earn around 14-30% annually. But with this type of investment there is also a much higher likelihood of a 100% loss.

Consumer loans

If you invest in consumer loans, you are practically providing financing for private persons. These loans are typically secured by personal guarantee and have a projected interest of around 8-18%.

Conclusion of Moonpeer

If we could only invest in one crowdfunding platform, Moonpeer would definitely be our top choice. They have made it possible to invest in over 10 crowdfundong platforms with only one account. This makes it simpler and more convenient than ever to make proper diversifications crowdfunding.

We also like the fact that platforms are analyzed and verified before integration to Moonpeer.

Media Contact

Company Name:-Moonpeer

Email:-[email protected]

Company Website:-https://moonpeer.com/

The post Moonpeer, the world’s leading investment marketplace appeared first on Zex PR Wire.