Bitcoin, the largest cryptocurrency by market cap, has experienced significant bearish pressure following a major transfer by the Mt. Gox exchange.

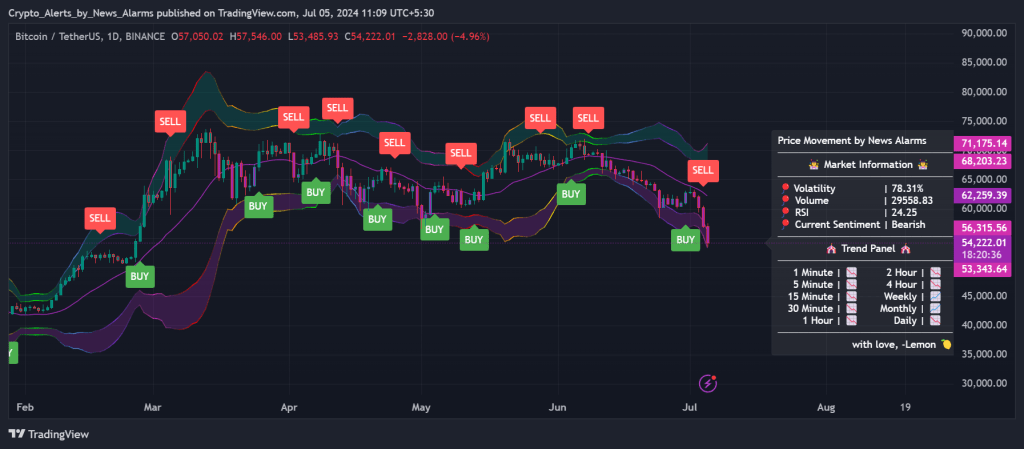

Bitcoin’s Sharp Decline

On the Bitstamp exchange, Bitcoin’s price dropped to $53,350 at 4:19 UTC, marking its lowest level in five months. This sudden decline follows a massive transfer of $2.71 billion worth of Bitcoin to a new wallet by the now-defunct Mt. Gox exchange.

Mt. Gox’s Impact

Last month, Mt. Gox announced plans to start repaying victims of the 2014 hack, resulting in substantial selling pressure from creditors. This announcement has been a major bearish factor for Bitcoin. Despite this, JPMorgan analysts believe this pressure will be temporary, predicting a potential rebound for Bitcoin prices by late summer.

Also Read: Timetable Set for Consensys Lawsuit Against SEC

JPMorgan’s Optimism

JPMorgan suggests that some creditors might hold onto their Bitcoin due to tax reasons or belief in future price increases. This sentiment could mitigate some of the immediate selling pressure.

Also Read: KfW Launches €100 Million Blockchain Bond, Marking Digital Finance Milestone

Additional Selling Pressure

Bitcoin bulls are also contending with selling activity from the German government, adding to the bearish outlook.

Market Sentiment

Data from cryptocurrency analytics platform Santiment indicates that social media is rife with fear, uncertainty, and doubt (FUD), evidenced by a high number of “sell” mentions. Despite this, Bitwise Invest CEO Hunter Horsley remains optimistic. He suggests that the recent price crash does not fundamentally change Bitcoin’s value, urging investors to “keep calm and carry on.”

Also Read: Mike Novogratz’s Top Tip for Learning About Crypto Investing

Conclusion

While Bitcoin faces significant challenges due to recent events, some analysts and industry leaders remain hopeful about its long-term prospects. The current bearish phase may be temporary, with potential for recovery in the coming months.